Chipping Away $25,000 in Credit Card Debt: the 12-Month Game Plan

By: Shaybleu

Written on 1/13/2024

Hey, Bleu Bells! 💙

Let's dive into something hefty today – tackling a mountain of credit card debt. We’re talking $25,000 hefty. But guess what? You can smash it in just 12 months with a solid plan and serious commitment. Ready to roll up your sleeves and dig in? Here’s how:

Commit to the Climb First off, take a deep breath and commit. Paying off this kind of debt isn’t a stroll in the park – it’s a climb, but it’s doable.

Ensure you’re in a place financially where you can take this on. It’s more than just a plan; it’s a promise you’re making to the future you.

How to do it: Sit down, take a deep breath, and look at your finances. Can you realistically tackle this debt?

If so, write down your commitment. Post it somewhere visible as a daily reminder of your goal.

Remember, Rome was not built in a day. This will take some time to review your finances without judging yourself. Could you align everything to your goal and drop the past financial mistakes? We all made them and will continue to do so, but awareness and action will be the key to STOP and making better financial decisions.

The ‘No’ Season

Time to tighten those purse strings. Say goodbye to fancy dinners out, random shopping sprees, and those tempting trips to HomeGoods. It’s all about prioritizing your future financial freedom over immediate gratification.

How to do it:

Create a budget and identify areas where you can cut back. Instead of dining out, cook at home. Swap shopping sprees for DIY projects. This is about saying 'no' to temptations and 'yes' to your financial future.

Cook at home

Take a lunch to work

Do not go out to eat during the week or weekend

Cut down on your grocery shopping items. Make it consistent, easy, and affordable

No more going out for cocktails or lunch with co-workers or your friends

Make coffee or Tea at home “Buy a good thermal cup to keep it warm throughout the day”

No more shopping at department stores for items you do not need. You can do without candles, bath and body works plug-ins, or decorations during holidays

Delete the Amazon app

Delete any unused streaming apps. You only need one. Delete HBO Maxx, Netflix, Hulu, Paramount, Amazon Prime Video etc.

Take a moment and search your account for all the monthly subscriptions you pay for and calculate how much money you are spending monthly

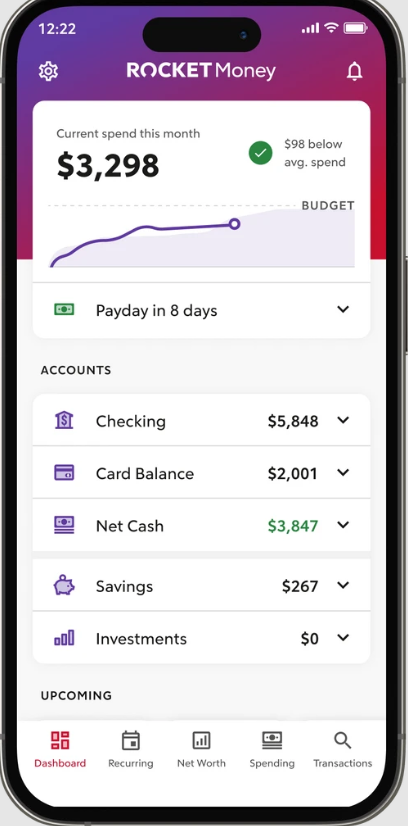

Cancel any unused subscriptions you are not using by downloading the app called Rocket Money This will help you manage your money coming out of your account every month.

12. Cancel that gym membership you never use and find a free community gym in your neighborhood, or utilize the one you pay for in your apartment

13. If you can work a part-time job with an extra 20 hours a week, do it! This will only help you stay busy to say no and focus on the goal of paying off your debt

Check out the article, 30 + Easy Remote Jobs for You to Consider in 2023 for a list of possible part-time remote jobs to consider,

14. Eat the same thing every week, increase the number of hours you work by obtaining a part-time job if you are able, pay your monthly amount and more if able on your credit card balance, and do not wait for others to support you do it and move on to the next financial goal.

Check out the article below for an affordable and healthy weekly eating plan.

15. Set the stage for what routine and discipline can do for your life.

16. Stay consistent

17. No vacations, girl’s trips, visiting family on holidays, or family gatherings that cost funds

18. Stay within the plan even if you can only do what is in YOUR plan.

Break It Down

Let’s get down to brass tacks. Whip out a calculator and break that $25,000 into manageable chunks. How much must you pay monthly or every two weeks to hit your goal? Seeing those numbers can turn a mountain into a series of small hills.

How to do it:

Discipline

Use a spreadsheet, budget app, or pen and paper to divide $25,000 by 12 months. This gives you a monthly target. Even better, split that into bi-weekly targets for more manageable chunks.

The Math

25,000/12 months = 2, 083 a month

2,083/2=1,041 bi-weekly

Use your Google or Outlook calendar or bi-weekly reminder app. This will give a monthly reminder broken down by pay period to make this priority to pay along with your mortgage, rent, utilities, etc.

Keep to your commitment. I know this is not a small change, but what other choice do we have? We want to be debt-free and stay on track of the goal

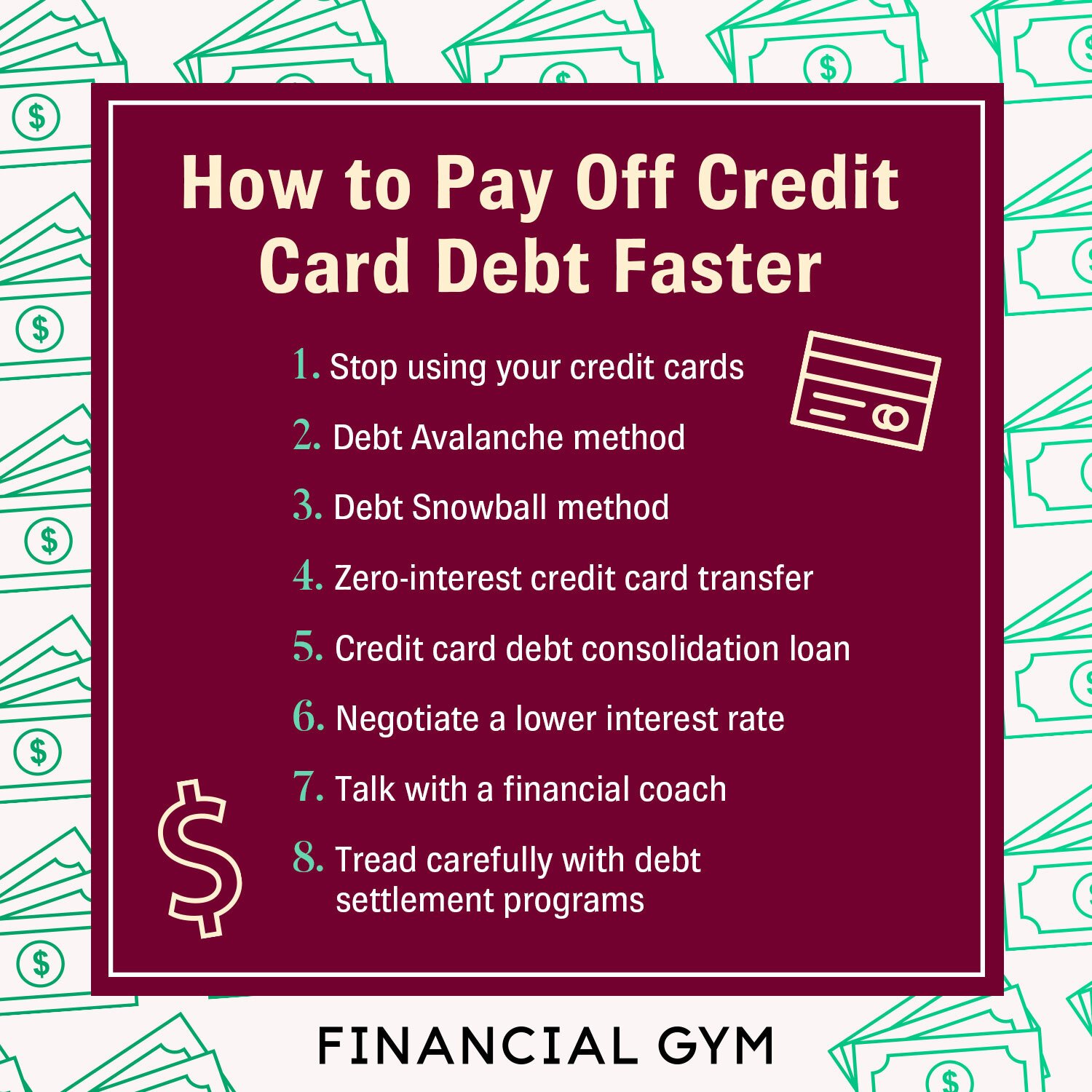

Look at this article, How to Pay Off Credit Cards in 7 Steps, for additional resources on paying off your credit card.

Look at this Credit Card Payoff tracker on Etsy below if you need a template to keep you on track!

I am all about pen and paper. I need daily reminders written in my journal of where I am at, to keep me centered on my commitment.

If you are old school like me. I use my daily journal to keep track of where I am with my debt and finances.

Trim the Fat

Take a hard look at your expenses.

Those sneaky little monthly subscriptions? Axe them. If it’s not essential, it’s not cutting. This step is about reallocating your resources to where they must go.

How to do it:

Go through your bank statements to find all your subscriptions. Decide what's necessary and what's not. Cancel anything non-essential and redirect those funds to your debt repayment.

Cancel any unused subscriptions you are not using by downloading the app called Rocket Money

Set Up Success Systems

Automate your payments for the amount you’ve calculated. This is like putting your debt repayment on autopilot.

But don’t just set it and forget it – use your phone’s reminder app or calendar to ping you about upcoming payments. Stay in the loop and keep your focus laser-sharp.

How to do it:

Set up automated payments for your calculated monthly or bi-weekly amount. Use your phone or digital calendar to set reminders a few days before each payment. This keeps you in control and aware of your financial flows.

Below, you will find a list of Free Reminder Apps if needed to support your debt-free journey

Check out the article, 10 Best Free Reminder Apps to Stay on Top of Tasks in 2023

Keep Your Eyes on the Prize

How to do it:

Make a vision board or journal entry about life without this debt. Whenever you feel demotivated, revisit this vision to reignite your determination.

And there you have it – a step-by-step guide to breaking free from $25,000 of credit card debt. Remember, each step you take moves towards a more accessible, financially stable future.

Stay strong and keep pushing, Bleu Bells! 💙